DCB and Mobile Money: Key to Democratize Access to Digital Content in Senegal

In addressing the varied needs of the Senegalese population, the implementation of the mobile money payment option aims to broaden access to premium content. This effort is not intended to replace but to enhance existing available payment methods, such as Direct Carrier Billing, allowing users to pay for content in a way that best suits their needs. The integration of mobile money through Orange Money acts as a complementary layer, specifically catering to the 44% of the population reported by the World Bank to have a mobile money account. This integration enhances the overall payment flexibility, ensuring a more inclusive and user-friendly experience for a diverse audience.

The Importance of an Enhanced User Experience

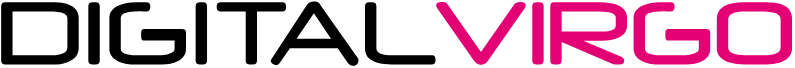

The primary goal of implementing this new payment method is to enhance the user experience. In this regard, the aim is to make access to content as seamless and accessible as possible while maintaining a simplified payment flow. Subscribers now have the option to validate payments conveniently through the Orange Money mobile app. Additionally, for increased flexibility, content access is also possible from a computer by scanning a QR code, expanding the available payment options.

The Broader Context: Impact in Sub-Saharan Africa

In the context of Sub-Saharan Africa, this initiative aligns with the broader trend of the mobile money revolution. Data from the GSMA highlights the region as a focal point for this financial transformation. In fact, the region is considered the global epicenter of this payment method, and the numbers are proof: 48% of all the registered accounts globally belong to this area, which means that in 2022 Sub-Saharan Africa had 763 million mobile money accounts, out of the 1.6 billion accounts worldwide.

Senegal, in particular, stands out as a leader in Western Africa regarding bill payment through mobile money, boasting an impressive 27% ratio, which exemplifies the importance of this payment option in the country. Moreover, according to Statista, digital content consumption growth, especially in VoD (Video On Demand) in this country, emerges as a significant trend, with a projected 43.4% penetration rate by 2027. These two factors together create the perfect environment to host this new launch.

If you want to implement our solution, contact us.